SpiralPanels:

The Industry Pioneer

SpiralPanels VS Competitors:

Offering Level

SpiralPanels' structure can address the limitations identified in prior research on conventional solar power architectures. Most importantly, it overcomes one of the most persistent problems of stacked solar structures—shading of the lower layers—by installing independently actuated reflective panels. These reflective panels can redirect incoming sunlight to eliminate shading, thereby maximizing power-generation efficiency.

SpiralPanels VS Competitors:

Positioning

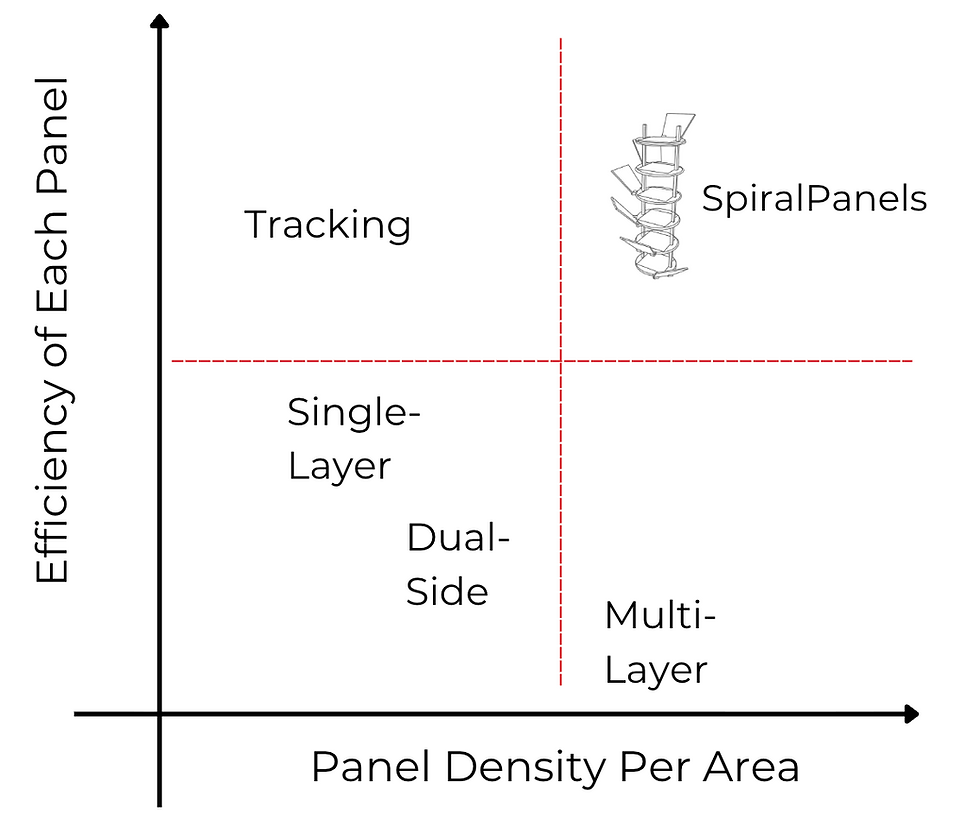

SpiralPanels outperforms other designs by improving both panel density and per-panel efficiency, which usually trade off. Its stacked structure packs more panels into the same footprint, and its selectively actuated reflective panels redirect sunlight to reduce inter-layer shading, keeping each panel productive. As a result, it achieves higher output per land area than single-layer, tracking-only, or conventional multi-layer systems.

Profit Model

SpiralPanels earns revenue in three ways: (1) an upfront integration/IP fee, (2) recurring licensing for its dual-axis reflection control algorithm and updates, and (3) a share of incremental REC revenue. The model works because SpiralPanels cuts total CAPEX (~40%), especially land-related costs, so SPVs can achieve the same annual output with less land and lower land payments, creating savings that exceed the added EPC complexity. That margin gives SPVs a clear incentive to pay SpiralPanels.

Upfront IP Fee

A one-time payment from the SPV when SpiralPanels is installed—covering system design/engineering, structural blueprint use, and integration support. Essentially, the SPV pays to “buy into” the SpiralPanels architecture.

Algorithm Licencing

A monthly / annual subscription fee for using SpiralPanels’ proprietary control algorithm that optimizes reflective-panel movement, plus ongoing software updates, monitoring, and performance tuning.

REC Revenue

Because SpiralPanels increases generation, it creates additional RECs. The SPV keeps the RECs but contractually shares a portion of the extra REC revenue attributable to SpiralPanels’ added output.

Market Trend

SpiralPanels boosts power-generation efficiency, making it a cost-effective, scalable alternative to conventional single-layer solar structures. As countries commit—through agreements like COP28—to rapidly expand clean energy capacity, solar remains the dominant driver of renewable deployment (about 81% globally, per Global Market Outlook for Solar Power). With the global renewable energy market projected by Grand View Research to grow from ~$1.51T in 2024 to ~$4.86T by 2033, the sector’s expansion creates strong commercialization tailwinds for high-efficiency generation architectures.

SpiralPanels Market Analysis

Our market spans three layers. The TAM is the global renewable energy market at roughly $1.6T (Grand View Research), showing large worldwide demand for higher-efficiency solar architectures. Our initial SAM is South Korea’s solar power market, estimated at $2.2B (Spherical Insights), where land constraints make output-per-footprint especially valuable. Our near-term SOM targets Korea’s reachable renewable/solar companies—about 118 solar businesses generating ~KRW 6T in revenue (Renewable Energy Center)—a concentrated customer base for pilots and early deployments before scaling globally.

Timeline

In the short term (0–1 year), we stabilize the prototype and run small pilots to secure verified energy and carbon-reduction data. In the mid term (1–3 years), we convert this validation into commercialization by signing initial B2B licensing partners, scaling installations, and standardizing carbon reduction per unit area. In the long term (3+ years), we expand through multiple partners to drive large-scale adoption in land-constrained regions, using a licensing/royalty model that scales revenue without a proportional increase in operating costs, enabling growth with minimal added operational cost.